The surge in transactional fraud

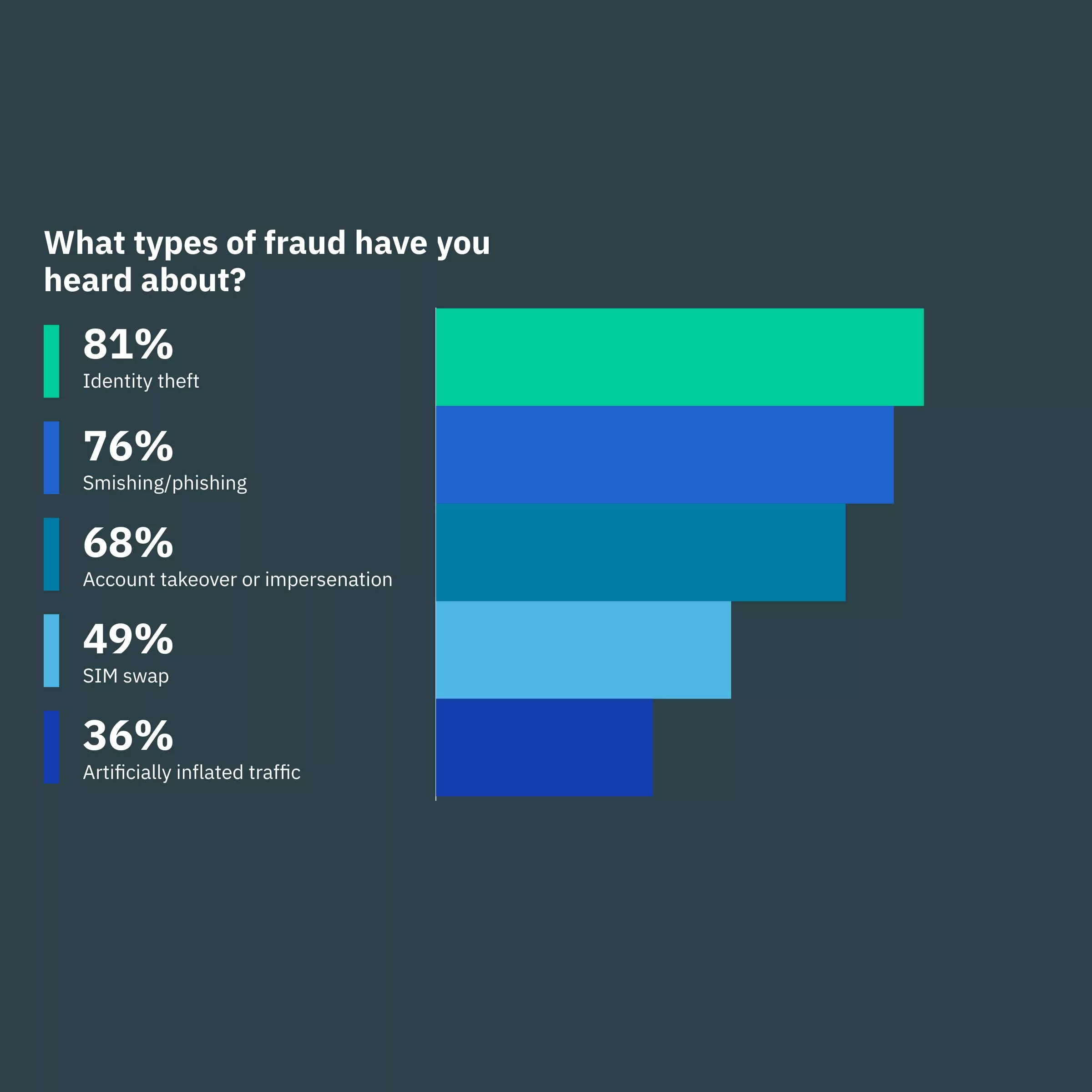

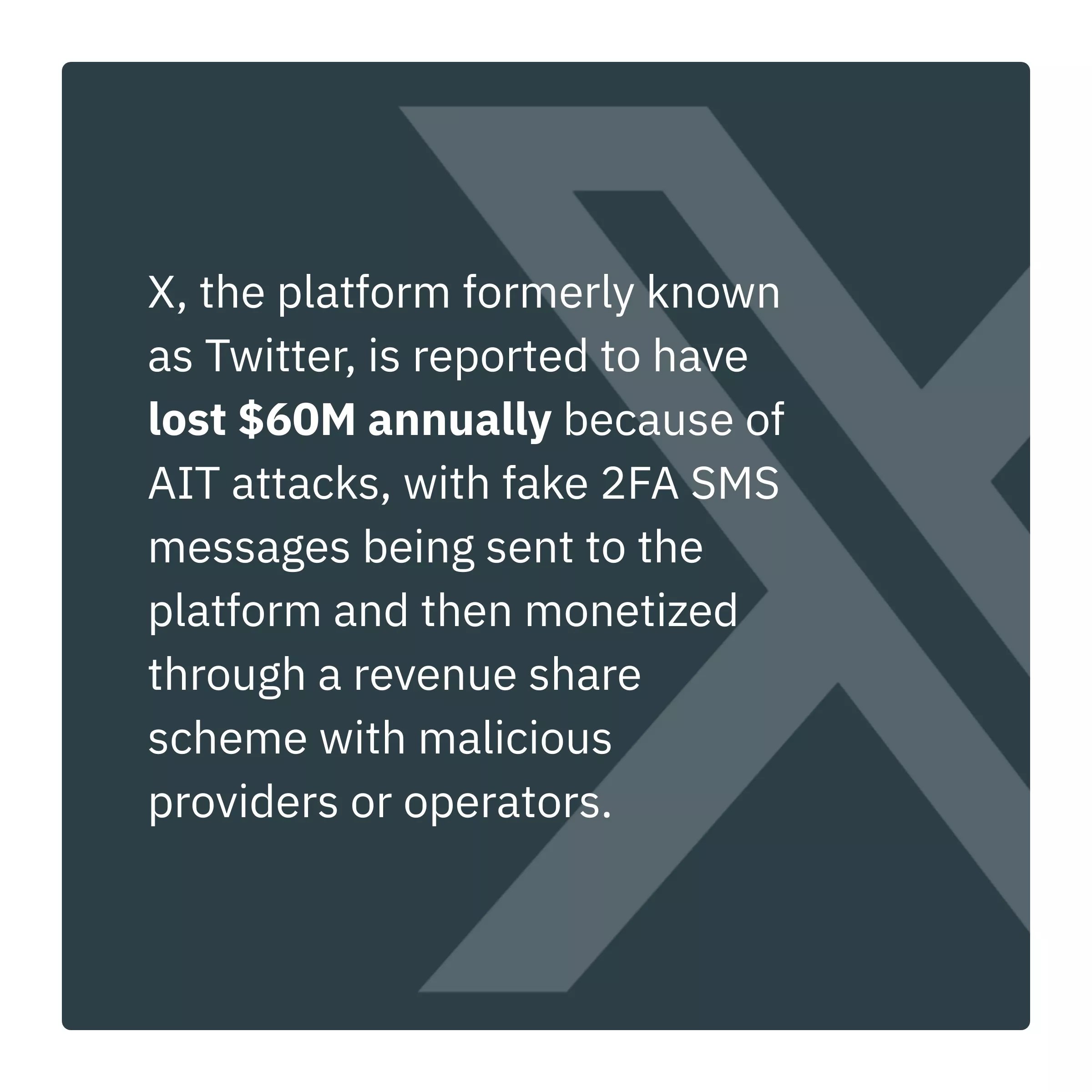

Fraud is an umbrella term covering a great variety of tactics used to exploit companies’ and customers’ vulnerabilities. As interactions between customers and companies evolve and take different forms – calls, A2P, rich messaging, chatbots – so do the ways in which fraudsters can get the better of users to obtain sensitive information.

-

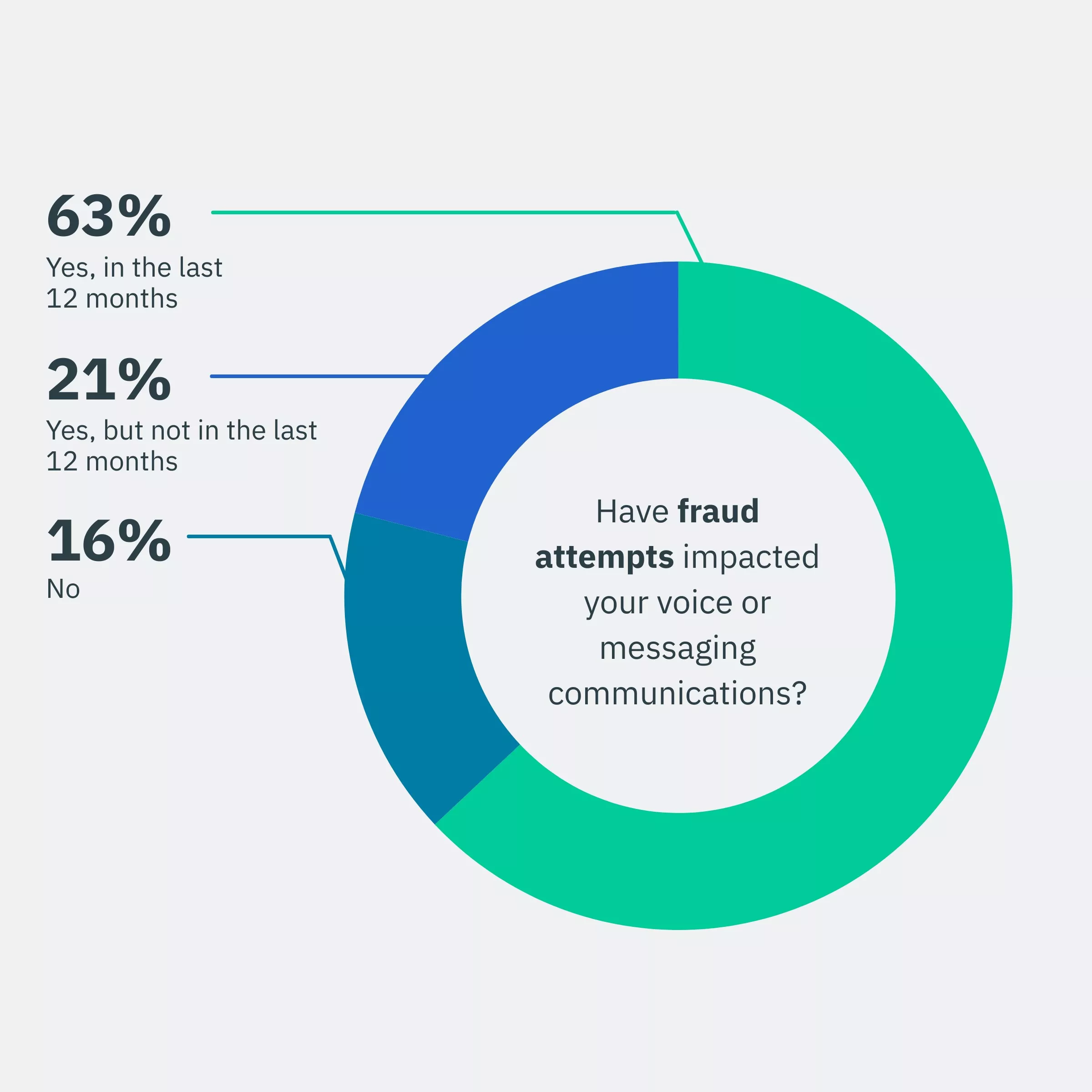

The results show that this is, in fact, the case. CCaaS and CPaaS providers are experiencing a significant increase in fraud attempts. An overwhelming 63% of respondents say their business has been the victim of a transactional fraud attempt in the last 12 months.

-

In the face of rising fraud, companies are gearing up to increase their fraud protection efforts: the vast majority (80%) of respondents say that fraud prevention will be a more important issue for their company in the next 24 months. This is especially true in companies with 500+ employees, 84% of whom say fraud prevention will be a more important issue in the next 24 months – unsurprising considering the volume of fraud large companies have to face.