Security solutions are in place…

We have seen that fraud is an increasingly important and costly issue with a growing negative impact on businesses and customers, which requires a considered approach and a state-of-the-art fraud prevention solution. Do businesses have this in place?

-

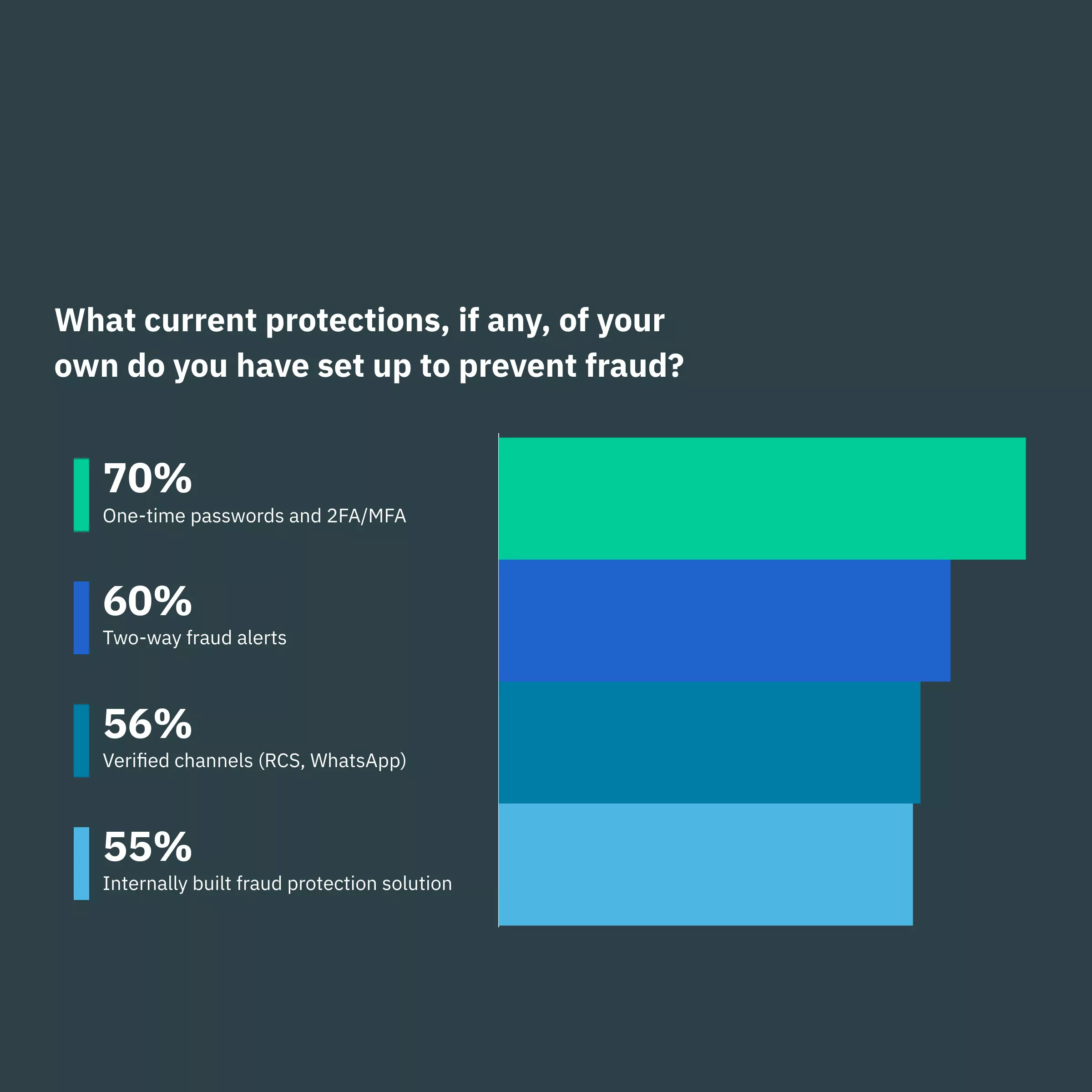

The good news is that the majority of companies already have a fraud prevention solution in place. 70% of respondents use 2FA/MFA, 60% have set up two-way fraud alerts, and 56% use verified channels like WhatsApp to keep themselves protected.

-

This shows that fraud really is an important concern for companies and that most of them are making active investments in preventing it or at least reducing its impact.